Checkout · Optimising payments for European businesses

October 2023 - February 2024

Improving the value proposition of Checkout’s AI powered payment optimisation product.

Company

Checkout, UK

(Working as a senior product design contractor from the London office)

Collaborators

7 Engineers, 1 Product designer, 2 Data scientists, 1 User researcher

Contributions

Product design, Research, Information architecture, Interaction design and prototyping

Tags

B2B, Web, ML, payments, fintech, dashboard

Goal

Improve the value proposition of the Intelligence Acceptance dashboard and the overall product to help participating merchants understand their data, increase conversions and unlock untapped revenue from their payments.

Outcome

With over 60 million optimisations per day, participating merchants have seen up to 9.5% uplift in acceptance rates, translating to over $10 Billion USD in revenue recovered as of March 2025.

What is intelligent acceptance?

Today, payments are so ubiquitous that we often forget that each one is a unique combination of data points that are catapulted across issuers, schemes and payment service providers, each with a unique set of frameworks, rules, preferences and technologies they utilise to process your request. Beyond these are the legacy systems often patched together with unknown bugs, complex data mapping and layers of inefficiencies, leading to a lot of false declines and lost value for businesses.

Checkout aims to fight the false decline problem with modern technology in the shape of their new payment optimisation product—Intelligent Acceptance. The Intelligent Acceptance product takes global acquiring, issuing, payment processing, authentication and Network Token data (amongst other data points)and runs it through a range of algorithms that analyse and select, in real-time, the best paths for any given transaction.

Leading with value

Checkout launched the beta version of Intelligent Acceptance in 2023 as an additional service, but as the team worked on improving the optimisation engine, they struggled to get more merchants to use the service. While merchants on the beta saw gradual improvements in revenue, they struggled to understand what optimisations were being applied and how it affected transactions on a daily basis.

The goal was simple: provide more valuable insights that will lead to actions which increase acceptance rates and more revenue for merchants. Better acceptance rates will in turn incentivise merchant partners to assign more traffic to Checkout — more share of wallet.

Illustration of the difference between created and perceived value of IA to merchants

Research and planning

Requirement gathering workshop (2023)

I joined the Payment Performance team as a Senior Product Designer a few months after the beta launch, working as the design owner for the Intelligent Acceptance product, collaborating primarily with Engineers and Data Scientists to help improve the user experience of the product. To kickoff the project, I ran a week long requirement gathering workshop with stakeholders to gather context on what had been done and what to prioritise going forward.

Building on the workshop, I worked with existing research data gathered from merchants on the beta, highlighting a list of pain points merchants had that we could directly tackle, according to what we prioritised during the workshop.

Improve merchant experience

Poor visual design: Confusing charts, unclear visual hierarchy, lack of granular controls for insights.

Poor empty state handling: Allowing users select time periods where we can't show data, then display inadequate error messages.

Inconsistent metrics: Metrics are often inaccurate, Merchants get more information from support queries, leading to more inbounds.

Make insights more reliable

Unavailable data: ~25% of merchants struggle to access data due to low statistical significance.

Complicated data: Merchants are confused with the meaning of some metrics and computation. Metrics can variate depending on time.

Non-cumulative metrics: Metrics are not cumulative today i.e they don't add up over time (e.g. revenue) which is counterintuitive for a dashboard.

Intelligent Acceptance beta dashboard (June 2023)

Key improvements

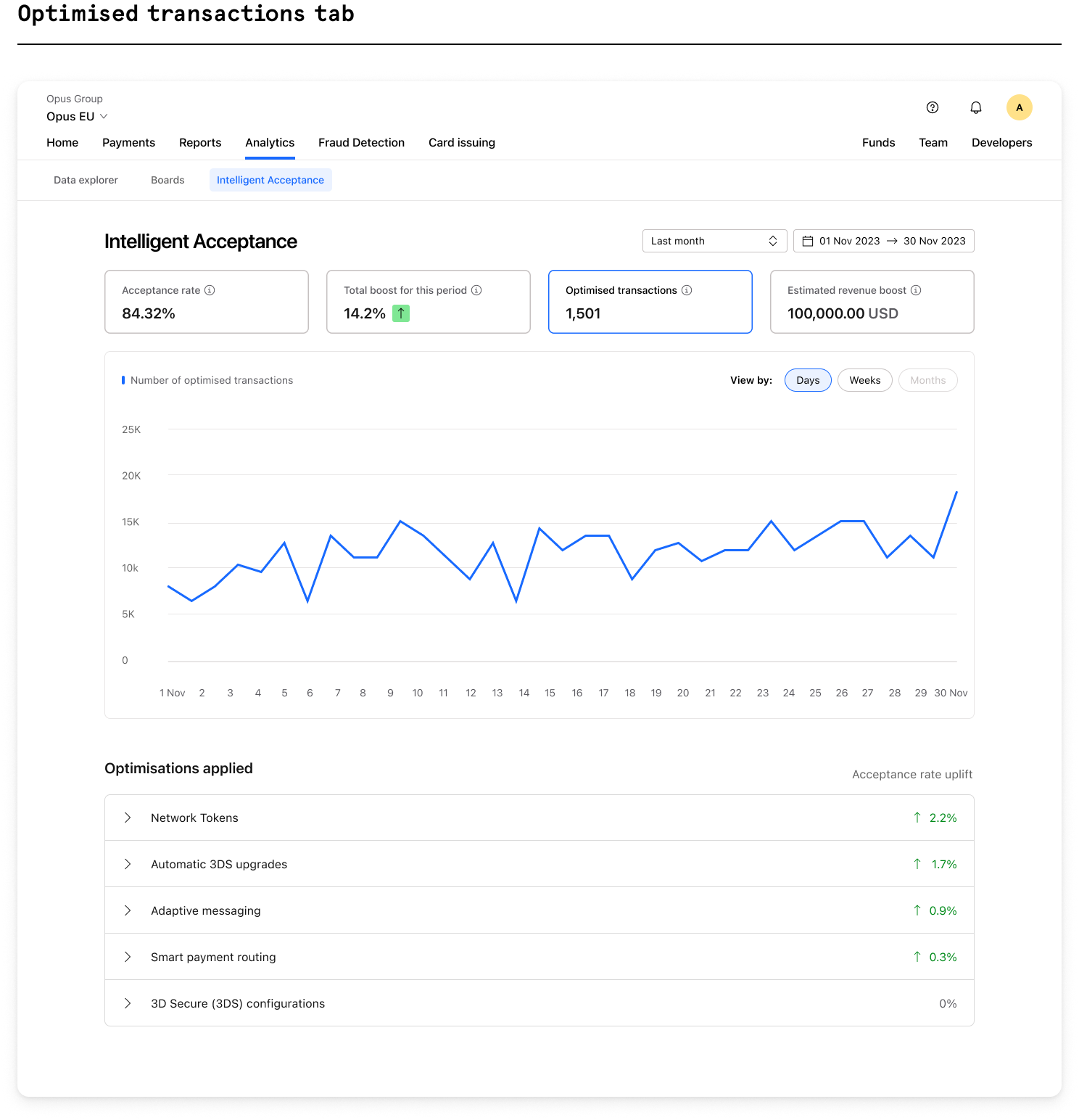

Improved metric computation: Changed the way we compute lA metrics, and now calculate cumulatively on a regular schedule (daily, weekly or monthly).

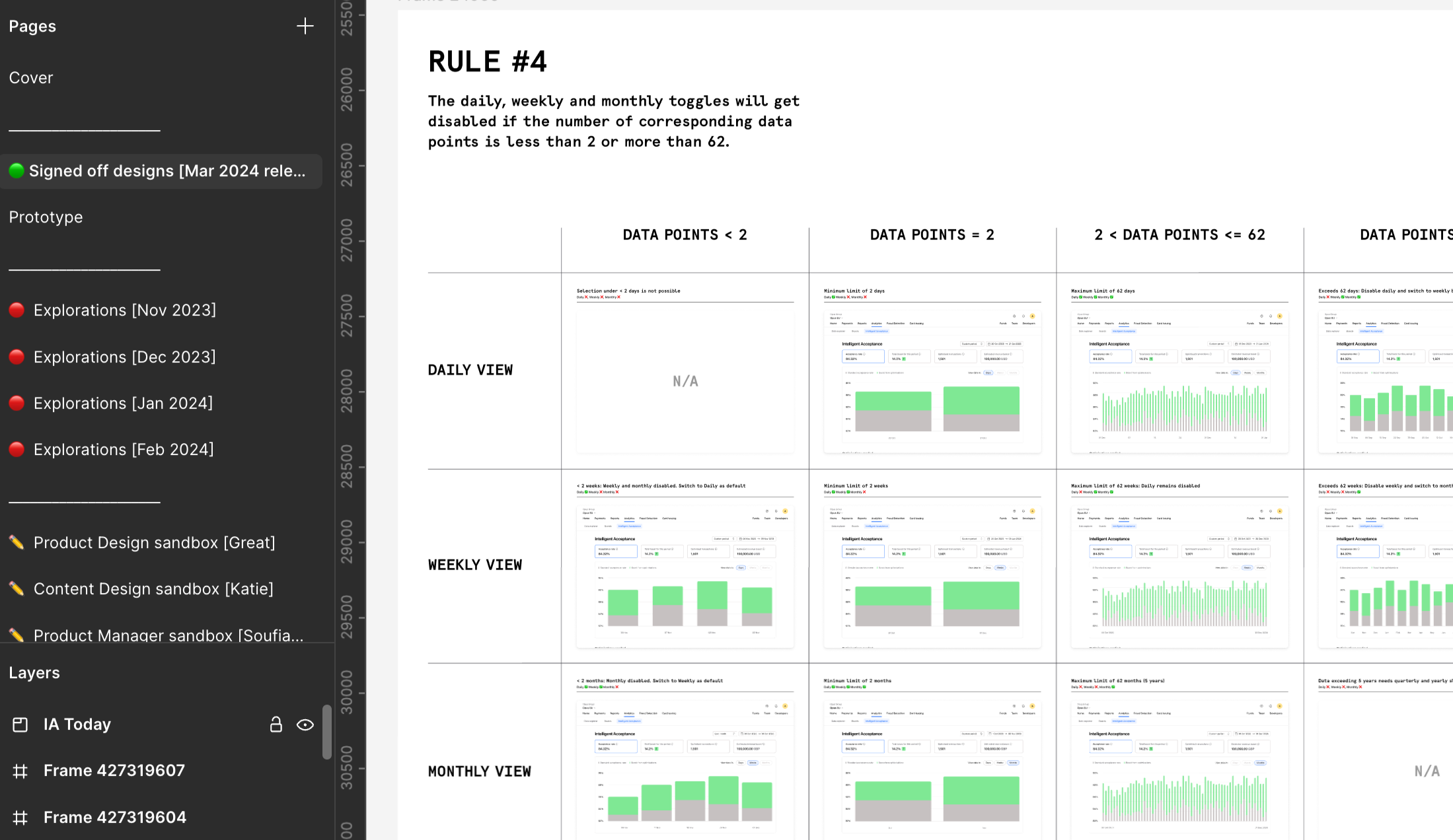

Improved data visualisation: Introduced several data visualisation adjustments, including a flexible bar chart with more accurate data and the ability to adjust data granularity.

Display optimised transactions: In line with displaying more accurate metrics, the transactions saved count (a calculated figure), has been replaced with the more absolute transactions optimised, which we have more confidence in.

Pre-formatted time periods: Added better surfaced pre-formatted time periods to allow merchants easily select commonly used time periods that work best with the data we have for them.

More accurate data: Changed the data visualisation methods to better accentuate the difference between baseline acceptance rates and the uplift provided through Intelligent acceptance.

Improved insight granularity: Added more functionality to give merchants more control over how they see their data.

Final design solution

Conclusion

The IA project was OKR 1 for Q4 2023 and slated for release by Q2 2024, so it was a very high visibilty project. I had to go through several iterations really quickly, taking feedback from Checkout’s Chief of Product as well as a number of design directors on the team. It was a very exciting project for me as I got to work really closely with payment data and was given a lot of trust and freedom to get the best outcome.

A significant learning point for me was the idea of always keeping my Figma file readable and properly annotated as it had a lot of eyes on it.